Consider Investing in a Living Trust

An estate plan provides you and your family with peace of mind. When you plan on saving your refund in a general savings account these days, there are not a lot of options for earning interest. However, the peace of mind you can get with an estate plan may mean more to you than the possible 2% interest you could get from a savings account. Don’t get us wrong, saving your money is very important, but protecting your savings is just as important!

Estate planning has many benefits. It ensures you have done all you can do to keep your hard-earned money away from the government, it gives you the opportunity to memorialize your wishes regarding healthcare, child rearing and distribution of your things when you’re gone.

An estate plan is for you, no matter your walk of life, whether your assets are large or small, we have plans for everyone. This is the time to manage your future so someone else doesn’t make the wrong decisions for you. Building your legacy is not something you can do in one day, but it is created day by day with the choices you make. We can draft your estate plan within 24 hours. Now is the time to create your estate plan, your future, and your legacy!

Why do I need an estate plan?

- Avoids probate court. Without a plan, your assets are distributed according to the laws of intestate succession; the state chooses your heirs for you! The process of distributing your assets, called “probate,” is expensive and time consuming for you and your family.

- Saves money

- Pick your own heirs

- Pick guardians for minor children

- Trusts are not public record (privacy)

- Learn about community property

- Control future healthcare

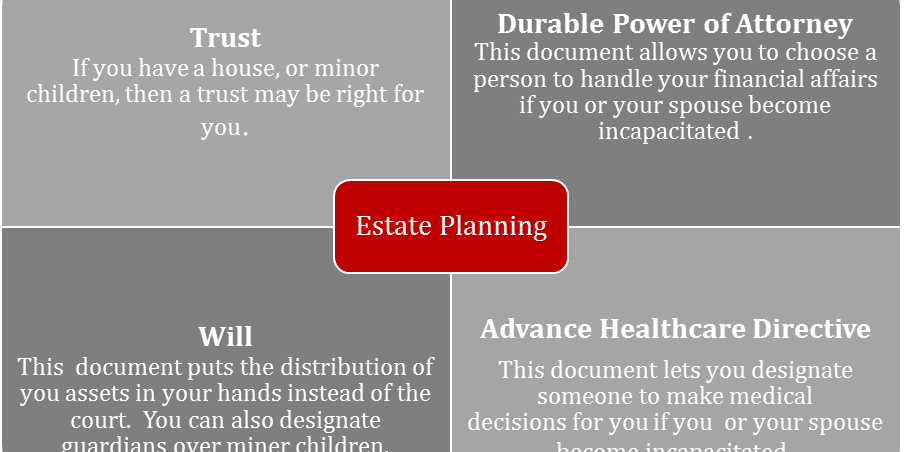

What does an Estate Plan consist of?

Co-authored with Lasha Hernandez

Merrill A. Hanson

Law Office of Merrill A. Hanson

180 N. Glendora Ave., Ste. 201

Glendora, CA 91741

Tel./Txt: 626-905-4682

Originally Published March 28, 2016

_____

This page is not intended to convey legal advice. You should contact an attorney for your specific situation.